FreeMarks

A better engineered cryptocurrency

Frequently Asked Questions (FAQs)

The advent of cryptocurrencies presents a unique opportunity to establish a robust and equitable monetary system for the digital era, one that is economically anchored in the tangible value of the physical world. Regrettably, many modern cryptocurrencies have emulated the most problematic features of government-issued fiat currencies, thereby undermining their transformative potential.

A primary concern with fiat currencies is their lack of intrinsic value, a characteristic that enables governments to issue currency without corresponding economic output. This practice, historically unprecedented, facilitates unchecked money creation, leading to currency debasement. Consequently, the wealth generated by individuals and businesses is eroded, effectively imposing an implicit tax beyond explicit fiscal obligations. Financial institutions, which often support this system, disproportionately benefit from this wealth transfer.

The phenomenon of inflationary taxation has resulted in the loss of vast economic value over recent decades, conservatively estimated in the hundreds of trillions. This systemic issue burdens economies, as governments increasingly rely on borrowing to sustain operations, perpetually raising taxes to offset the diminishing value of currency. Such practices underscore the unsustainability of current fiscal policies, placing an undue burden on future generations who inherit escalating debt and the specter of potential state insolvency.

Despite these challenges, innovators and entrepreneurs continue to drive economic progress through groundbreaking technologies, problem-solving, and the creation of novel markets. Their contributions sustain global economies, even as governmental policies often fail to deliver commensurate value, instead accruing debt that hampers future prosperity.

The rise of cryptocurrencies, exemplified by Bitcoin, reflects a public demand for systemic change. However, Bitcoin and similar cryptocurrencies remain fiat in nature, lacking intrinsic value and relying primarily on network effects for their utility. While Bitcoin’s success highlights the potential for decentralized financial systems, it does not fully address the structural flaws of fiat-based economies.

To realize a more stable and equitable financial future, we propose the FreeMark, an innovative asset-backed digital currency developed by Worldfree. The FreeMark is designed to serve as a superior medium of exchange, pegged to a diversified basket of 20 commodities to ensure resistance to both inflation and deflation. By offering early adopters and users attractive returns through Growth Rate Royalties, the FreeMark incentivizes participation and fosters widespread adoption.

We invite your support to advance this initiative, which aims to establish a monetary system grounded in tangible value and economic integrity. Together, we can challenge the cycle of financial misrepresentation and build a foundation for a more prosperous and sustainable world.

Because 65% of the funds raised are put in an endowment, called the FreeMark Reserve Endowment (presently with assets of roughly $245k of the $370k raised), in order to provide liquidity and ROI growth in the asset-backing.

Over time, the percentage of new funds that acquire FreeMarks will rise to 90%, to be placed directly in the asset-backing, thus raising the percentage backing overall from 65%.

In addition, there are 1% transaction fees, 1/4 of which go to FreeMark owners who validate transactions (available to everyone), 1/4 to the FreeMark Reserve Endowment, 1/4 to Worldfree, and 1/4 to partners who use the FreeMark for their transaction processing.

Thus 0.25% of transaction fees will go towards the FreeMark Reserve Endowment asset-backing, and the projections plan for 100% asset-backing within three years of the general FreeMark release, with expected ROIs of 6-7% annually after fees in the FreeMark Reserve Endowment.

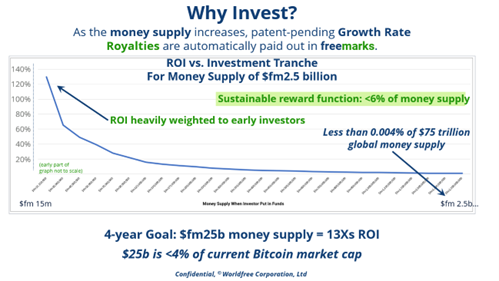

ROIs are explained below. For instance, if an investor invests at the $5m tranche, and the FreeMark money supply grows to $2.5 billion, that is a growth rate of about 130% times their investment. This electronic paradigm is fixed in the FreeMark, and scales upwards by a factor of 10. That means that if the money supply grows to $25 billion (still only 0.025% of the global money supply), the original investor would benefit by an ROI of 1,300% times their investment, while those investors who entered in the latter part of the $150 million of early investors would realize a 130% ROI. This provides continual incentive as the FreeMark meets its market and grows in usage globally.

There is, as for all investments, a risk inherent in the system. The primary value provided by the FreeMark is to maintain the purchasing power of your FreeMarks by pegging them to a basket of commodities, which will reflect inflation more accurately than government-generated inflation indexes, while minimizing the effects of supply and demand on any one commodity with a basket of 20 different ones. The value rises as commodities rise in price, keeping up with inflation, and fall in the unlikely case of deflationary economies with fiat currencies. But in an overall economic collapse, because the FreeMark Reserve Endowment holds assets these values may also fluctuate.

Thus, the FreeMark is a rationally-designed alternative. However, as it is a value and must be achieved, a risk is involved to keep growing the asset-backing FreeMark Reserve Endowment. No reward without risk, that is a general principle of life.

If the 3-year goal of $2.5 billion FreeMark money supply is achieved (unlike other cryptos, the FreeMark money supply keep expanding the money supply to keep up with demand, because savers benefit), then the return for those who buy in the first $15m tranche is 130%.

When the money supply attains $25 billion, then the ROI for early investors will be 1,300%, or 13Xs.

Since the returns are paid after the money supply growth, they do not become liabilities until after funds from sales of FreeMarks have already been collected. FreeMark sales are currency sales, different than equity or product sales, as a different asset class, discussed more thoroughly in the Business White Paper.

FreeMark sales are not investments, but currency exchanges, although we utilise some of these revenues for development purposes and the FreeMark Reserve Endowment provides liquidity for all FreeMark owners.

The financial plans for the growth of the money supply project 100% asset-backing before the end of year 2028.

Yes, commodity prices go up and down for many reasons, including the arbitrary whim or the possible misinformation driving the decisions of any particular currency buyer or seller.

If the price of commodities goes up, for whatever reasons, then FreeMark owners benefit by the increase in FreeMark price. If commodies prices decline generally, then societies are experiencing deflation, and your money is more valuable, but because its price is tied to the world through commodities, they will generally cause overall prices to drop as they are the raw materials used to produce and deliver all the goods and services.

In this way, they have both inflation and deflation resistance. Because the price of the FreeMark is pegged to a moving average of commodities, savers also have resistance to general market volatility.

Buy investing part of the FreeMark Reserve Endowment to hedge against commodity price changes, economies of scale are utilised to provide this hedging exposure for all savers. Instead of all savers having to practice the art of currency hedging, which is difficult, it is done for them and incorporated in the functioning of the FreeMark, making it a better currency for international transactions.

Right now, we are introducing the $fm, but later will will introduce the AU$fm, £fm, the €fm, the ¥fm, ₹fm, the ₽fm, and other currencies that are local to our users.

Because of inflation/deflation resistance, they are covered, and because each of these different FreeMarks are priced in the local values of the same amounts of the same commodities, they provide the same inflation/deflation resistance. There will be some variation, for instance between a commodity in one currency jurisdiction and another, they will have slightly different values, but mostly commodity prices are maintained at different places because of international arbitrage trading.

At Worldfree, our mission is to foster honorable and mutually beneficial economic exchange by equipping individuals and businesses with tools to deliver genuine value to their customers. We are committed to supporting your right to financial success, recognizing it as a cornerstone of economic sustainability and a vital defense of individual liberties. The name “Worldfree” embodies this commitment to empowering wealth creation and free exchange.

We believe that generating wealth is the most effective means of safeguarding personal and political freedoms, a principle often misunderstood or misrepresented. To this end, the Worldfree Network is purposefully designed to help you achieve financial prosperity by outperforming competitors through innovation, strategic insight, and a deep understanding of your clients’ needs. Our success is tied to yours: by enabling your financial growth on transparent terms, we drive our own progress, fueling the development of cutting-edge solutions.

Collaboration is at the heart of our philosophy. By respecting each other’s right to thrive, we create a supportive ecosystem where individuals and businesses can achieve greater independence and resilience. This approach does not involve circumventing laws but emphasizes outsmarting competition through superior preparation and client-focused strategies.

Globally, many individuals face governance systems that prioritize control over public welfare, often at the expense of economic and personal freedoms. Governments, by their structure, wield significant power with limited accountability, and mechanisms such as elections frequently fall short of delivering meaningful change. As discussed in our White Paper, true democratic systems are rare, and bureaucratic structures often perpetuate oligarchic tendencies, fostering dependency rather than empowerment.

We assert that governments frequently prioritize policies that limit individual wealth to maintain control, promoting altruistic ideals to justify economic sacrifice without equitable return. This dynamic, rooted in envy or collectivist ideologies, undermines personal agency and economic vitality. Historical and contemporary examples, such as the economic collapse in Venezuela despite its vast oil reserves, illustrate how wealth confiscation strips citizens of their political liberties, resulting in widespread hardship and displacement.

Public sector bureaucracies, often disconnected from value creation, rely on coercive taxation rather than voluntary exchange, expending resources to justify their relevance while contributing minimally to societal progress. A more principled alternative exists: individuals should be free to create and exchange value in a competitive, consent-driven private sector, where success is earned through innovation and customer satisfaction.

Worldfree advocates for a transformative approach, grounded in honesty and economic empowerment. We invite you to join us in building a future where individuals can create wealth, defend their liberties, and thrive in a system that rewards value creation over compliance with outdated paradigms.