A Medium of exchange engineered to preserve the purchasing power of your wealth

Reduced volatility because the FreeMark is pegged to 20 of the world’s most traded commodities

Uniquely, as the money supply grows, you earn royalties for owning FreeMarks

Built upon the Nodechain®, your wealth is more secure because your transaction data is not public.

The FreeMark is Unique as a Digital Currency for Five Reasons:

1. There is a reliable basis for its valuation—its value is explicitly and automatically pegged to a basket of commodities, and the source of value behind the FreeMark that provides liquidity to its user base are assets that are marked-to-market.

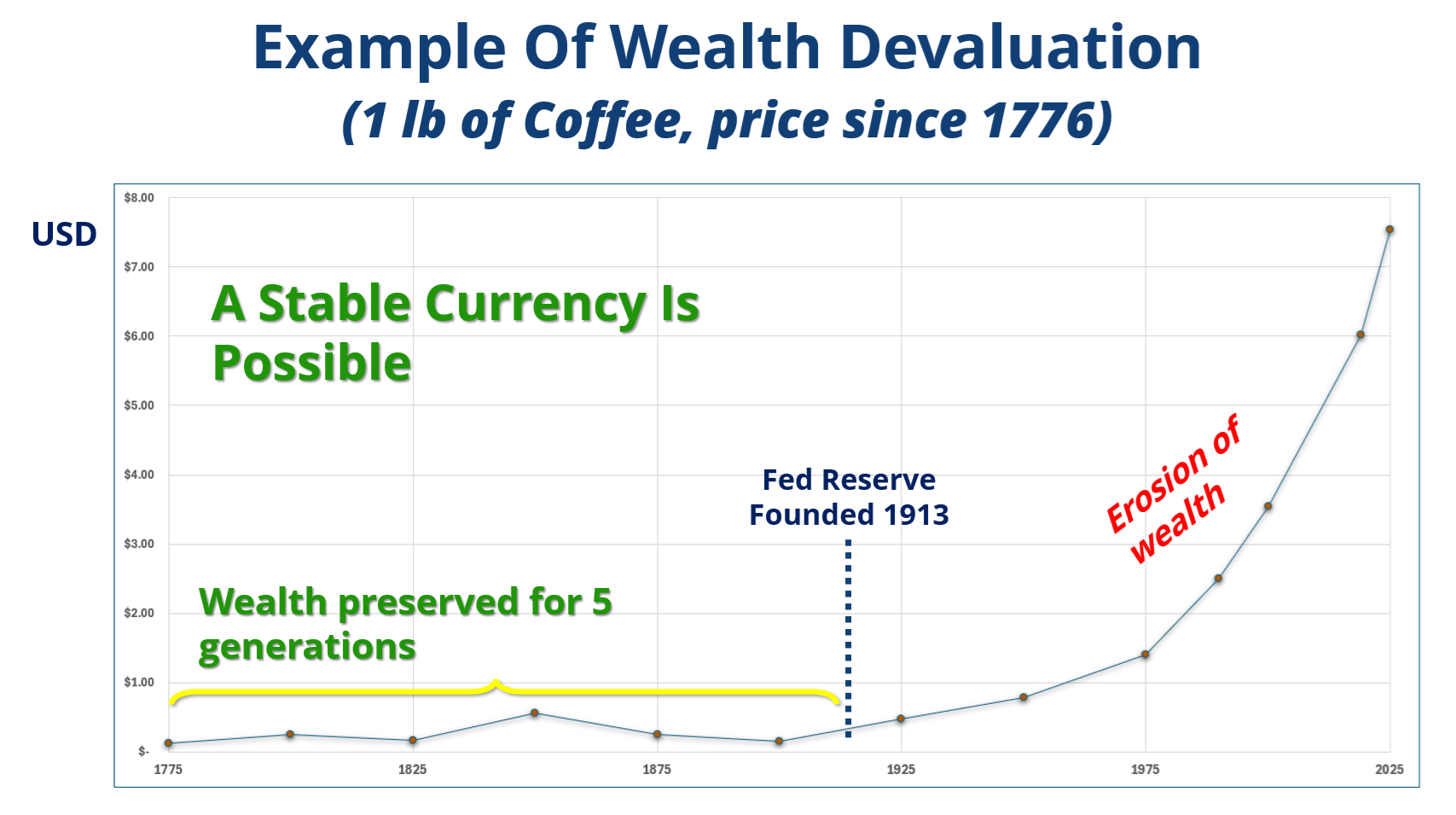

2. The basket of commodities ties its value to the physical world. Since most goods are made of the 20 commodities, their prices are a proxy for inflation—when they go up generally (when the paper currency they are priced in inflates), then the FreeMark increases with respect to the paper currency, protecting FreeMark owners against devaluation.

3. The FreeMark is stable: if the price of aluminium rises, that does not imply that the price of sugar will rise (or fall), as they are generally uncorrelated. Because there are 20 commodities in the basket, the various factors that affect each commodity tend to average out, leaving only a stable proxy for inflation.

4. The FreeMark is engineered to be a better medium of exchange. It is not primarily an investment medium, as it is designed to be stable in order to reduce risks in local and international transactions and protect its owner’s wealth from devaluation.

5. Early investors can earn outstanding rewards if the money supply grows (just as owners of an equity can realize high returns if a company is successful). People want to earn a return on their savings. When the use of the FreeMark increases, owners receive a royalty that is sustainable with the FreeMark paradigm.

Many crypto-enthusiasts want to disassociate people from the basis of a currency’s price: this is not practical for any currency that has actual value behind it, for instance, a gold-backed currency or one backed by real estate assets, or one for which the liquidity is provided by many kinds of assets held in a regulated trust fund, as is the case for the FreeMark. The value of every asset depends on what others are willing to pay for it, which changes constantly, and the condition or state of the asset, which also is subject to constant change. The assessment of the value of every asset also is open to differing interpretations.

Thus people must always be involved in determining the actual value of assets, because the value is always determined by the state of the asset as well as the market for it.

Your wealth is worth less, and less, and less...

But it was not always that way

The FreeMark can restore the permanency of your family's wealth

Cryptocurrencies will never achievemainstream adoption unless VOLATILITY is overcome

Rational Investing???

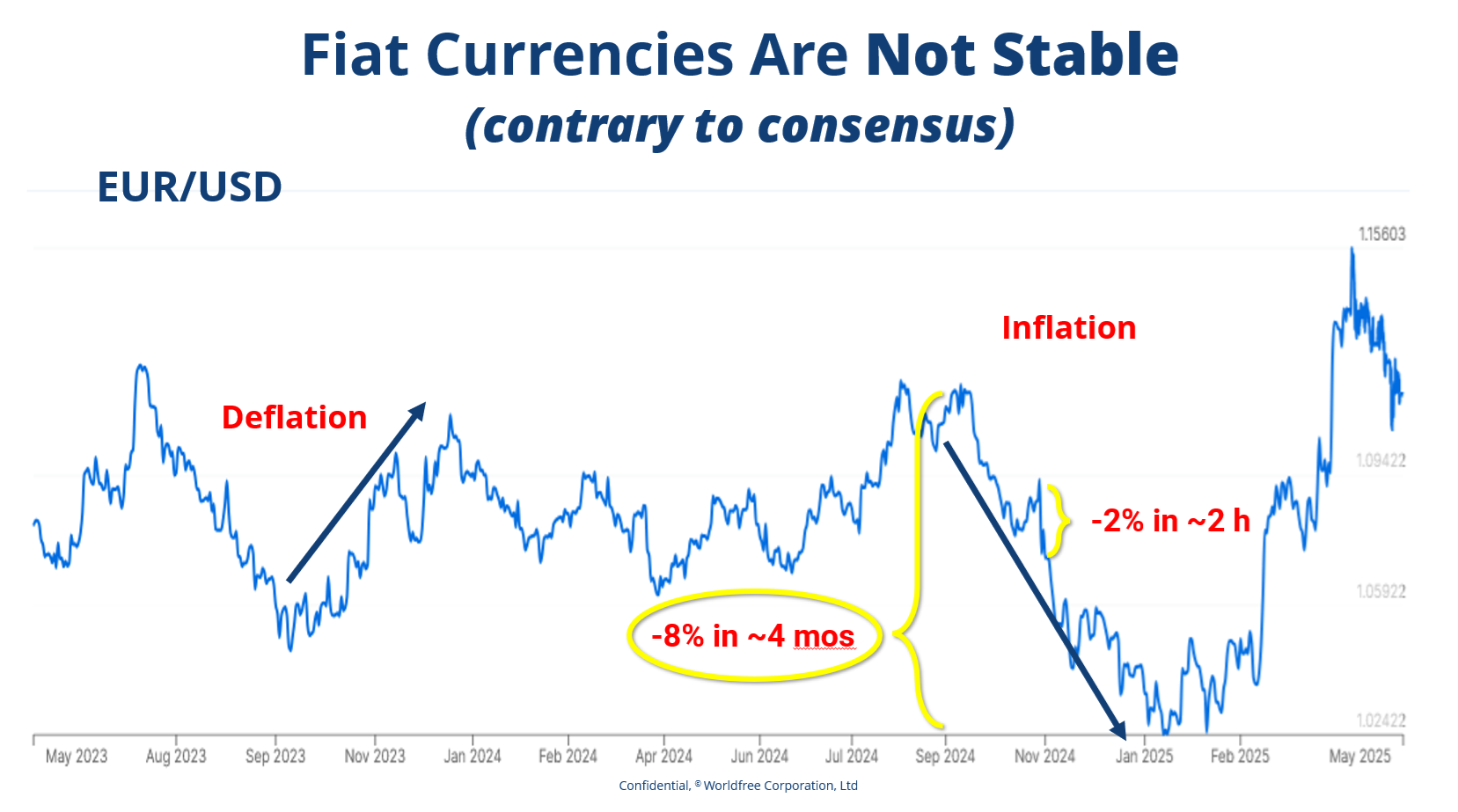

How can you make even a ~10% annual return consistently when you are trading in and out of a volatile fiat currency, or in the future with a cryptocurrency?

Worldfree Solution:

The FreeMark

EARLY

BUYERS

Returns on ownership of 10Xs or more are possible with FreeMark for early buyers, upon the expansion of the money supply.

As an investor, you need a stable currency to trade from.

As a manufacturer, you need a stable currency to trade with.

As a business person, you need a stable currency to buy and sell with.

As an individual, you need a stable currency to maintain and protect your family wealth's purchasing power.

Other cryptocurrencies call themselves stable.

But how are they stable if they peg to the volatile USD?

The USD can vary between 1-5% per week—it's one of the most stable fiat currencies!

We have all been lulled into accepting this excessive volatility as normal.

But volatility means greater risk and complexity for manufacturers, traders and those who do any kind of international business.

FreeMark Owner Comments

“Keeping the purchasing power of a currency is crucial to the holder, and we have all seen firsthand how inflation has deteriorated that power. FreeMark, with its Nodechain along with being connected to commodities, makes it unique—a hybrid between Bitcoin and gold-backed U.S. dollars. If executed correctly the FreeMark will give the holder confidence and ease of mind of holding something of value.”

Marcel R.

“The best impact investment thesis I've ever heard, or am ever likely to hear.”

Cliff S.

“To me, the FreeMark is the first digital medium of exchange addressing the lack of sustainable asset backing which is the root cause of prevalent currency instability. Worldfree takes on a real-world problem, has a convincing solution and the execution firepower needed to overcome challenges. Based on this evaluation, the rational choice was to buy FreeMarks!”

Marius L.

Introducing the Worldfree Team

Kevin Kirchman

CEO

A 3-time entrepreneur, founding companies using technologies including artificial intelligence, robotics and engineering. Built one AI company that a G200 firm offered to acquire. Began career many years ago working for his family's software firm, the Kirchman Corporation, at one time the US's largest banking software firm. He has written one book on innovation, with degrees in mechanical and aerospace engineering (Cornell U) and computer science.

Dr Theo Mourouzis

Technical Advisor

Dr Theo Mourouzis is a Research Fellow at the UCL Centre for Blockchain Technologies (UCL CBT) and Programme Director of the MSc in Business Intelligence and Data Analytics at the Cyprus International Institute of Management (CIIM). Theo received his PhD in Computer Science (with specialisation in symmetric cryptanalysis) from University College London (Information Security Group), with a BA/MA in Mathematics from University of Cambridge.

LinkedIn

Guillaume Goutaudier

Advisor

An expert in IT project and product management and network security with a speciality in blockchain technologies.

LinkedIn

Paul Kristensen

Advisor/Investor

An expert angel investor and serial entrepreneur with a passion for turning unique technology into successful business. A highly experienced company chair and director of both public and private companies, having taken IP-based companies to IPOs and other exits both in Australia and internationally.

LinkedIn

Simon Cocking

PR Advisor

The Chief editor Irish Tech News and Cryptocoin.News, #1 ranked ICO advisor on ICObench for last 3 months.

Winner of Irish Web Awards 2014, best Science & Technology category, and Winner 2016 Littlewoods Best Ireland Blog for Digital & Tech.

LinkedIn

Marius Lohri

Advisor/Investor

A Worldfree investor and successful venture investor, with many years of experience as a product developer. Focus on strategic thinking and developing strong value propositions.

LinkedIn

Glenn Bolger

Advisor

A Bitcoin trader, miner and broker, with many years as an IT professional. Thorough knowledge of the cryptocurrency market, its history and basis for its growth.

LinkedIn

Dr. George Tian

IP/Chinese Market/Legal Advisor

A Senior Lecturer at the Faculty of Law, the University of Technology Sydney (UTS), Australia. Specialized in intellectual property (IP) commercialisation, anti-trust law, privacy law, transfer pricing, digital law and policy.

LinkedIn

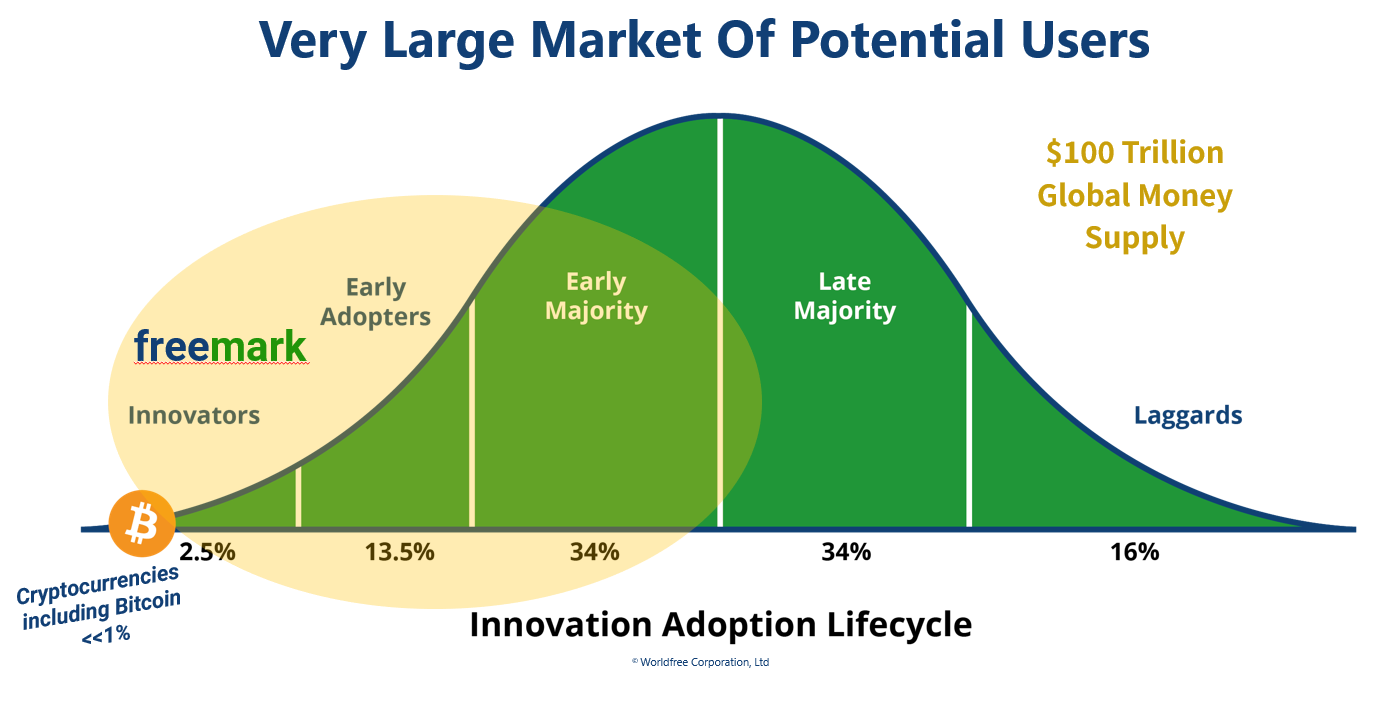

The FreeMark is aiming for the bigger opportunity: the market for the next phase of cryptocurrency adoption is ~30% of the global GDP, or about $40 trillion in payments.

Many cryptos tout their justification for use in financial transactions, thus expanding cryptocurrency use. But volatile digicurrencies, using the prevailing model of varying market price, behave in exactly the opposite way of the best medium of exchange.

The best kind of currency for everyday financial transactions is stable: more stable than fiat currencies, and certainly more stable than most cryptocurrencies.

But that is not enough. The larger market needs an incentive to switch to a cryptocurrency. It must be stable, but it also must produce a return. The FreeMark does this by paying a royalty based upon the growth rate of the money supply, completely reversing the inflationary erosion of savings by making natural market growth an ally, and incentivising viral growth.

FreeMark owners will in addition buy and sell globally without exchange rate risk, with both inflation and deflation resistance. FreeMarks are also legally tied to real assets, held in a regulated, audited fund, unlike other fiat money offered by governments or mainstream cryptocurrencies.

How can you trade volatile assets with a volatile cryptocurrency?

The volatilities multiply, making rational investing impractical at best.

Furthermore, for traders in goods and services, such as manufacturers, importers and exporters, exchange rate risks and hedging practices are a real problem. A stable cryptocurrency, based upon a peer-to-peer, distributed platform solves that problem, and provides incentive for the switch.

Until a stable cryptocurrency becomes mainstream, no cryptocurrency will be mainstream

Governments removed asset-backing in the early 1970’s, floating currencies globally so they could print as much as they wanted. By creating money from nothing, they devalue the wealth their populations have earned through hard work and innovation. Already taxed horrendously, most developed governments have put their countries deep into debt. Now new generations are stuck with obligations they cannot expect to meet: they are slowly becoming slaves to incompetent bureaucrats who create little value for their people in exchange for the money they confiscate.

Faced with this nightmare, people invented the Bitcoin and other cryptocurrencies, and once again gave themselves some hope for better lives. What is this solution? They are printing money for nothing, just like their governments! They are also “taxing” people to provide currency, and taking a little of that from the governments. At least people are making money while they do it, however.

But the invention of digital money is a much better opportunity than these innovators realised. Instead of more fiat, in the form of Cryptofiat, Worldfree’s asset-backed, stable currency, the FreeMark, restores legitimacy to monetary policy, and automatically pays royalties to savers when the money supply expands, the opposite of inflation.

Because most of the money the currency is sold for is saved in order to back the currency in a managed, audited and regulated fund invested in physical and productive assets, the FreeMark is a better medium of exchange than government or crypto fiat, providing an opportunity for inflation and deflation resistant financial culture.

“Money is one of the greatest instruments of freedom ever invented by man. It is money which in existing society opens an astounding range of choice to the poor man, a range greater than that which not many generations ago was open only to the wealthy.”

Professor Friedrich August von Hayek, Nobel Prize, 1974

The Worldfree Network is a pro-business network, built by producers and value creators for value creators, in order to defend the greater freedom Hayek explained so eloquently.

“The only way to confirm the absence of a transaction is to be aware of all transactions.”

Satoshi Nakamoto, Inventor of the Bitcoin, in “Bitcoin: A Peer-to-Peer Electronic Cash System”, 2008

Well, this is not actually so—it is an invalid assumption. We can confirm a transaction has not occurred and changed the ownership of a coin if there is only one instance of a coin, as there is in every-day cash transactions.

Do you ask who owned money before accepting it as change in a transaction? Does anyone ask you?

Of course not—this is an example thousands of years old of another type of transaction—so why can’t that be replicated with the nearly infinite control we have of the digital world? Worldfree has done exactly that with its innovative, completely scalable Nodechain technology.

The Nodechain

Scalable, Simple

The FreeMark

Halts Inflation & Deflation

The Atomic Central Bank

Distributed Monetary Policy

[slide-anything id=’368′]

Join us to help make this new vision of a more robust and scalable digital currency platform a reality

Use of Funds and Allocations

History and Planned Timeline

Worldfree Software Corporation, Ltd.

London, UK